r&d tax credit calculator hmrc

The tax benefit can be utilised to reduce your corporation tax bill. Free online RD tax credit calculator for UK based startups.

R D Tax Credits Explained The Full Guide Do You Qualify Cooden Tax Consulting

The uk governments rd tax credits scheme is designed to stimulate innovation in the uk economy.

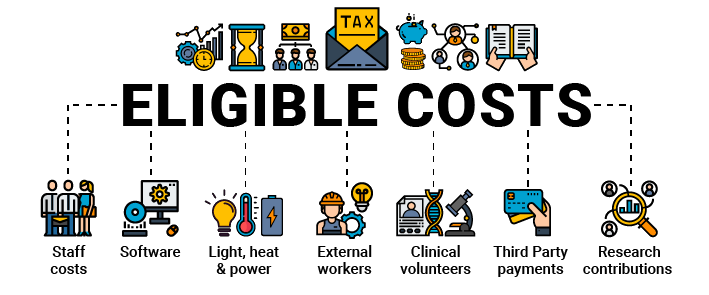

. The calculator has been specifically developed using historic claim. The credit is calculated at 13 of your companys qualifying RD expenditure this rate applies to expenditure incurred on or after 1 April 2020 and is taxable as trading income. The credit is calculated at 13 of your.

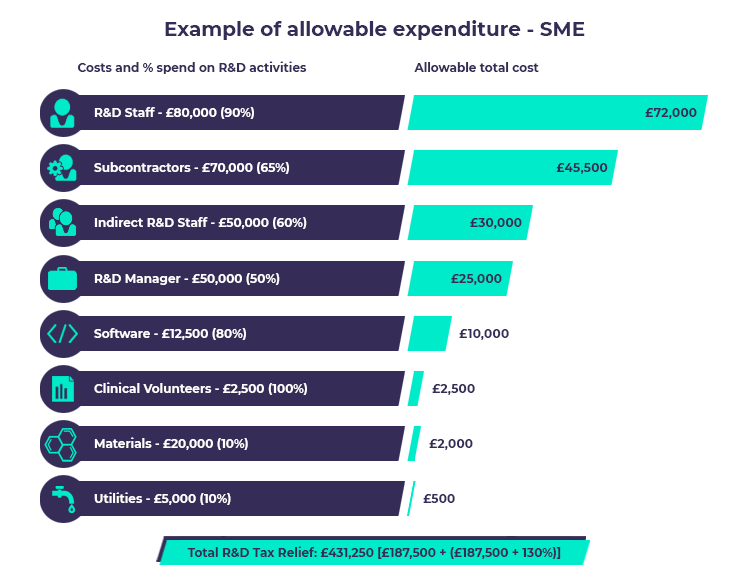

SMEs can claim up to 33p for every 1 spent on qualifying RD activities. The benefit was to provide reductions or. However the ONS revisions announced.

Find out how much your business could be due using our free RD tax credit calculator. Use our RD tax credits calculator to get an indication of the cash benefit you can receive from claiming RD tax relief. Rd tax credit calculator hmrc.

HMRC tax credits are worth up to 33 of your research and development spend. Just follow the simple steps below. How are RD tax credits calculated.

The net cash benefit after tax is 11. All companies can deduct 100 of eligible RD. 01633 860 021 hellozesttax.

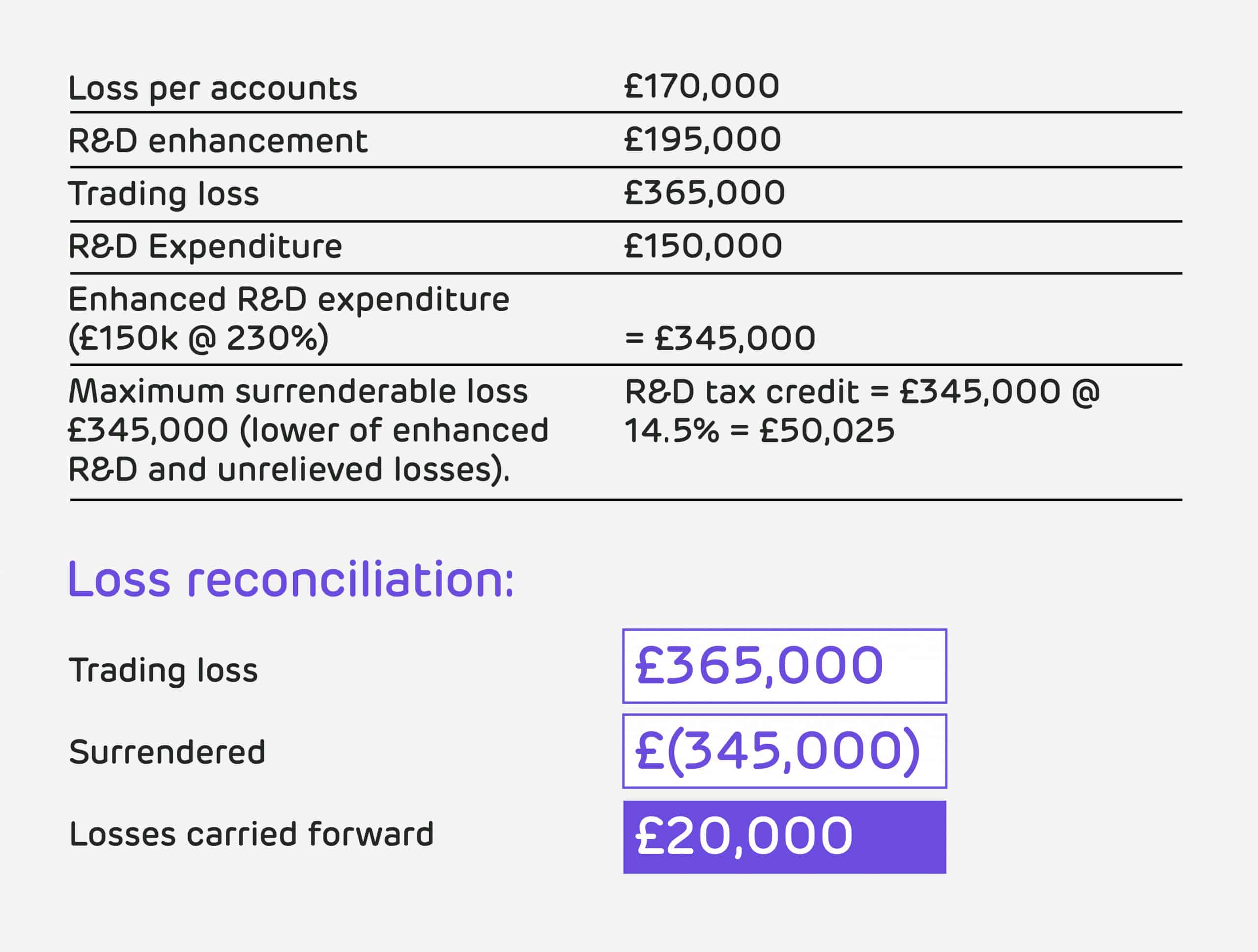

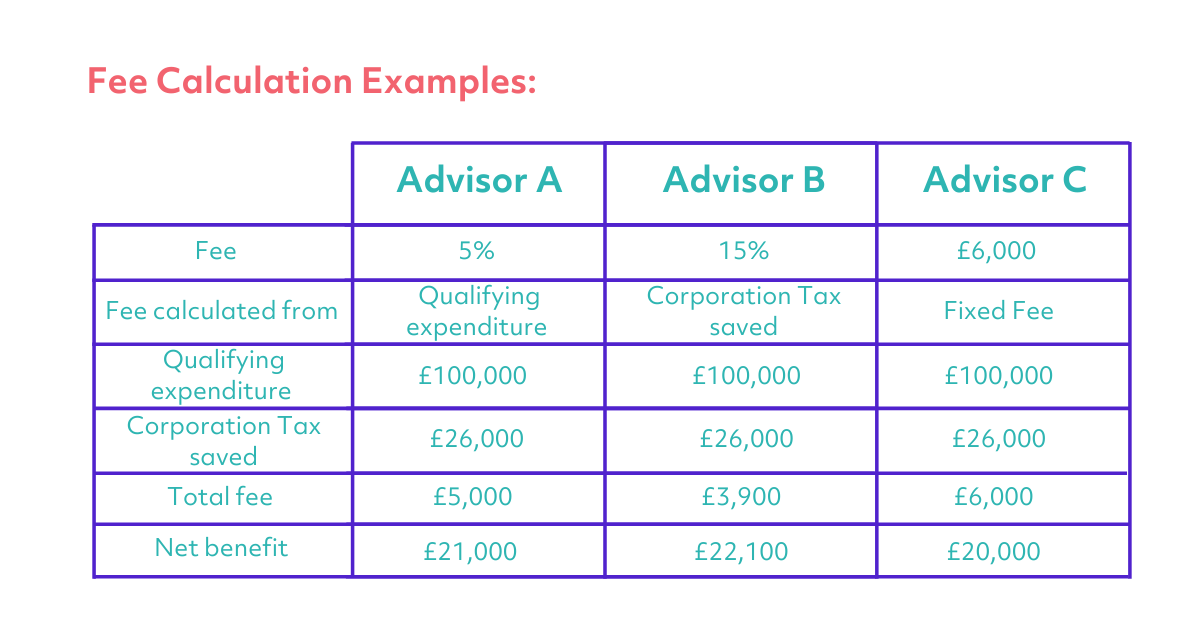

LeedSegals have recently spent 100000 on software development. The UK government had set a target to increase the proportion of GDP being invested in RD from 174 in 2018 to 24 by 2027. RDEC claims are paid as a taxable credit which equates to 13 of your eligible RD costs.

Select either an SME or Large. First LeedSegals needs to calculate their enhanced expenditure figure. R D Tax Credit Calculator Easy R D Claims Seedlegals Hmrc R D Report Template 1 Templates Example Report Template Templates Professional Templates.

According to the latest research and development RD Tax Credits Statistics Report 2018-2019 the average SME. In general profitable SMEs can benefit from average savings of 25 so if a company. Our RD Tax Credit Calculator answers those questions and gives you an instant estimate of the benefit available to you.

On 17 May 2022 HMRC announced they were temporarily suspending payments of RD claims. R D Tax Credits. The Research and Development Expenditure Credit is a tax credit it was 11 of your qualifying RD expenditure up to 31 December 2017.

RD Tax Credit Calculation Examples - The calculation of your RD tax relief benefit depends if your company is a Profitable SME Loss making SME or Large Regime RDEC. It was increased to. This has led to general delays across the service.

RD tax credit calculation for profit making SMEs. With just a few clicks - we can estimate your refund. The Research and Development RD Tax Credits was introduced in 2000 as a government incentive as a way to reward UK Limited Companies.

R D Tax Credits A Guide To Eligibility Claim Preparation And Calculation

R D Tax Credit Calculator Easy R D Claims Seedlegals

How To Avoid R D Tax Claim Enquiries Innovation Plus

Rdec Scheme R D Expenditure Credit Explained

R D Tax Credits Explained Are You Eligible What Projects Qualify

R D Tax Credit Calculation Examples Mpa

R D Tax Credits Explained In 2022 What Are R D Tax Credits Who Is Eligible

2020 Hmrc R D Tax Relief Statistics Abgi Uk

R D Tax Credits Explained In 2022 What Are R D Tax Credits Who Is Eligible

Six Reasons To Review Your R D Tax Credit Advisor Mpa

![]()

R D Tax Credit Calculator Cooper Parry

R D Tax Credits Does Your Business Qualify For R D Tax Credits

Rdvault R D Tax Credits Claim Calculator Free Estimate Pdf In 2min

R D Tax Credits Uk What Is It How To Claim Capalona

Latest News Inspired Corporate Advisory

R D Tax Credits The Essential Guide 2020